Nifty Likely to Open Deep in Red as Global Tariff War Escalates – April 8 Market Outlook

Pre-Market Sentiment: SGX Nifty Crashes Over 800 Points

After a relatively controlled correction last week, the Indian stock market is bracing for a sharp fall at the open today, Monday, April 8. Pre-market indicators are flashing red across the board as SGX Nifty has tanked over 816 points, currently trading at 22,146, indicating a gap-down opening of nearly 3.54%. This massive dip comes amidst global panic triggered by escalating tariff tensions between the US and China, with former President Donald Trump’s recent remarks acting as a key catalyst.

The market sentiment is highly bearish, with fears of intensified volatility throughout the day. A significant fall right at the open could set the tone for a highly volatile and negative session.

Friday Recap: Heavy Sell-Off Across the Board

On April 4, the Indian equity markets had already shown signs of weakness. The Nifty 50 closed at 22,904.45, marking a loss of 1.49% from the previous close of 23,250.10. The BSE Sensex, too, ended lower by 1.22% at 75,364.69, as compared to its previous close of 76,295.36. The decline was driven by poor global cues and ongoing concerns over the US-led trade war affecting investor confidence.

Global Trigger: Trump’s Tariff Shock Rocks Wall Street

Much of today’s bearish setup can be traced back to global developments. On Friday, Wall Street witnessed its worst single-day fall since the COVID-19 pandemic, after China retaliated with a massive 34% tariff on US imports. The Dow Jones Industrial Average plunged over 2,200 points, closing 5.50% lower at 38,314.86, while the Nasdaq Composite fell by more than 900 points, or 5.82%, ending the session at 15,587.79. The panic selling in US markets has had a direct impact on Asian markets, including India.

Nifty Support and Resistance Levels

From a technical perspective, today’s outlook remains extremely weak. The Nifty has support around 22,300 and 22,200, but those levels could be tested or even broken if the bearish pressure continues. Resistance remains firm at 23,000, and any upside move is likely to be capped due to weak global momentum.

Nifty 50 Technical Indicators Point to Further Downside

Key technical indicators are reinforcing this bearish view:

-

The Relative Strength Index (RSI) stands at 45, showing weakening momentum.

-

The MACD has turned bearish, signaling continued downward pressure.

-

The trend overall is clearly tilted in favor of the bears for the day.

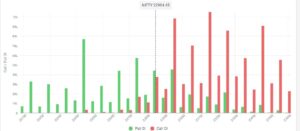

Open Interest (OI) Data Suggests Bearish Bias

Source : sensibull

Options data from Friday paints a similar picture:

-

Total Call OI: 6.6 crore

-

Total Put OI: 4.99 crore

-

Put-Call Ratio (PCR): 0.75

The highest Call OI is at 23,200 and 23,000, suggesting strong resistance. Meanwhile, the highest Put OI is concentrated at 22,500 and 22,200, indicating potential support zones that may get tested today.

India VIX on Watch as Volatility Increase

The India VIX is currently at 13.75, but with the sharp decline expected at the open and overall global instability, we may see a sharp rise in volatility throughout the session. Spikes in VIX are usually accompanied by heightened fear in the market.

Advice for Traders and Investors

With markets in panic mode and global uncertainty rising, today is not the day to go aggressive. Risk management should be your top priority. Intraday volatility could trigger stop-losses easily, so it’s better to wait and watch rather than rush in.

“When fear takes over, discipline becomes your best trade. Let the dust settle before taking aggressive positions.”

Also Read Nifty Pre Market Analysis : Key Points to watch 27 march 2025

Disclaimer:

The information provided in this article is for educational and informational purposes only. It is not intended as investment advice or a recommendation for any particular strategy, stock, or financial product. Stock market investments are subject to market risks. Please consult a qualified financial advisor before making any investment decisions. The author and the website are not responsible for any losses incurred based on the content presented above.

1 thought on “Nifty Set for Major Fall as Global Tariff War Escalates | April 8 Pre-Market Outlook”