Nifty 50 : Markets Eye Stabilization After Savage Decline; Some Initial Positivity in View

Following one of the steepest sell-offs in months, Tuesday morning is exhibiting some early signs of calmness — at least temporarily. GIFT Nifty is at 22,649, gaining 328 points or 1.49%, indicating a potential bounce following Monday’s sharp plunge. But overall market sentiment remains cautious, with technical indicators indicating that we may not have left the woods yet.

On the technical side, the Nifty 50 remains in a weak area. RSI has moved further down to 33.3 — technically in the oversold region — while MACD is still bearish, which means any upside could be fleeting unless accompanied by strong buying interest.

What Happened on Monday

Sources : Tradingview

Monday’s trade session was cruel for Indian marketplaces. NSE Nifty 50 plummeted 743 points (3.24%) to stand at 22,162 levels, which registered as one of the worst intraday falls over recent times. With this fall, the index has lost practically 1,700 points on its recent high of 23,870 witnessed on March 25. Even BSE Sensex was down heavy selling, and it was closed at 75,365 — down in excess of 900 points.

The sell-off was wide-based. Metal and Realty stocks were most affected, and both the industries plunged by 5–6%. Indeed, the Metal index dipped 6.75% and Realty slipped by 5.7%, graphically displaying the ferocity of the bearish mood.

Global Cues Still a Big Driver

A lot of the weakness continues to be propelled by global events. The US market experienced its own rollercoaster ride yesterday evening. The Dow Jones lost 349 points or 0.9%, but what caught everyone’s eye was the intraday swing — it had plunged more than 1,700 points during the day before turning around. This 2,595-point swing is now the largest intraday reversal in history.

The S&P 500 declined 0.2% after almost going into bear market levels. In the meanwhile, the Nasdaq closed merely higher at 0.1%, with investors choosing to purchase mega-cap tech giants like Nvidia and Palantir on select days. Undoubtedly, volatility isn’t so much an India story anymore — it is world-wide.

Derivatives Data Paints a Bearish Picture

Monday’s Open Interest numbers also endorsed the bearish leaning. Total Call OI was 6.6 crore whereas Put OI was 4.99 crore, driving the PCR to a mere 0.75 — a sure indication that bears are dominant. The peak Call OI continues to be at the 22,500 and 22,800 strikes, now serving as key resistance levels. On the downside, heavy Put OI at 22,000 is likely to act as some support, but the buyers’ defensive position is quite weakening.

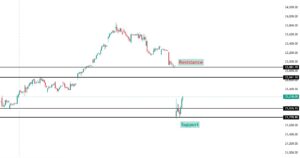

Nifty 50 Support and Resistance Levels

Volatility Spikes, FIIs Remain Defensive

India VIX jumped to 22.79 on Monday — an incredible 65% up in a single session. That is the highest since June 2024 and indicates the heightened fear among traders and investors.

Foreign Institutional Investors (FIIs) remained on a selling spree. On Monday, FIIs net sold ₹9,040 crore in the cash market, while Domestic Institutional Investors (DIIs) purchased ₹12,122 crore, bringing some respite. In index futures, FIIs were net sellers of ₹3,334 crore but were buyers in index options (₹14,633 crore), stock futures (₹1,861 crore), and stock options (₹6,183 crore).

FIIs’ long-short ratio for index futures has fallen to 25.14 from 29.01 in the last session. They also cut 21,023 contracts from index futures, further putting pressure on the bearish scenario.

Taking a glance at today’s session, Nifty has good resistance in the zone of 22,300–22,500 due to immense Call writing. On the downtick, 22,000–21,930 remains a strong support zone — technically, as well as psychologically. In case Nifty crosses 22,130, we can expect to move towards the 21,700 level in the near future.

What Can Traders Do Today?

The market remains volatile and choppy, with bearish undertones still intact. Today’s positive start could be a relief rally, but traders should remain cautious. With RSI oversold and VIX high, any bounce might face resistance quickly. Avoid aggressive long positions and focus on quality stocks with strong fundamentals if you’re looking to accumulate.

Short-term traders can follow a “sell-on-rise” policy until the index begins closing above the 22,500–22,700 zone convincingly. Until then, nimbleness and careful risk management are advisable.

2 thoughts on “Nifty 50 : Markets Attempt Recovery After Heavy Sell-Off; Early Signs of Relief, But Caution Still Key”